Stocks spike: Dow, S&P 500 post all-time highs as Fed maintains stimulus

By: JeeYeon Park | CNBC.com Stock Market Writer

Stocks finished sharply higher Wednesday,

with the Dow and S&P 500 logging fresh highs, after the Federal

Reserve surprised Wall Street by keeping its $85 billion-a-month

bond-buying program intact.

(Read more: How today's Fed statement compares to previous one)

"This has been music to the market's ears and a positive for risk assets across the board," said Quincy Krosby, market strategist at Prudential Financial. "But investors at some point will start to question the strength of the underlying economy...The chairman also did indirectly point to fiscal policy and no doubt he's following events in DC and the headline drama playing out on the budget debates so that could also have been a reason he decided to hold off now."

(Read more: How today's Fed statement compares to previous one)

"This has been music to the market's ears and a positive for risk assets across the board," said Quincy Krosby, market strategist at Prudential Financial. "But investors at some point will start to question the strength of the underlying economy...The chairman also did indirectly point to fiscal policy and no doubt he's following events in DC and the headline drama playing out on the budget debates so that could also have been a reason he decided to hold off now."

| Name | Price | Change | %Change | ||

|---|---|---|---|---|---|

| DJIA | Dow Jones Industrial Average | 15676.94 | 147.21 | 0.95% | |

| S&P 500 | S&P 500 Index | 1725.52 | 20.76 | 1.22% | |

| NASDAQ | Nasdaq Composite Index | 3783.64 | 37.94 | 1.01% |

The Dow Jones Industrial Average

spiked nearly 150 points, setting a fresh intraday-high of 15,709.58.

Most Dow components closed in positive territory, lifted by Alcoa and Home Depot.

The S&P 500 jumped to hit a new high of 1,729.44. Both indexes posted their best day since

June 13. The Nasdaq rallied to hit its best level in 13 years. The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, fell near 13.

All key S&P sectors closed in positive territory, propelled by materials and utilities.

The S&P 500 jumped to hit a new high of 1,729.44. Both indexes posted their best day since

June 13. The Nasdaq rallied to hit its best level in 13 years. The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, fell near 13.

All key S&P sectors closed in positive territory, propelled by materials and utilities.

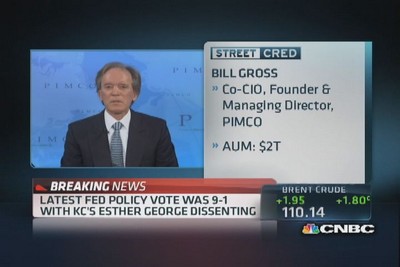

The Federal Reserve said it would continue buying bonds at the current rate

of $85-billion a month for now, surprising Wall Street. Strategists and

traders were expecting the central bank to announce a $10-$15 billion

reduction to its asset purchase program.

"The overall consensus was this was going to be the meeting where they started tapering—and to the extent that the Fed said they're data-dependent, I think they did the right thing," said Art Hogan, managing director at Lazard Capital Markets. "Meanwhile, the market's going to celebrate a more dovish Fed in the near term, but this may not be good news in the medium term."

The Fed also downgraded its outlook for the economy. The central bank now expects gross domestic product growth will be in the 2 percent to 2.3 percent range this year, down from 2.3 percent to 2.6 percent forecast earlier this year. It also cut the 2014 forecast to 2.9 percent to 3.1 percent from 3.0 percent to 3.5 percent.

(Read more: Taper: What Wall Street's favorite buzzword means)

Treasury yields slid, with the Benchmark 10-year yield at 2.76 percent, down from 2.86 before the Fed statement.

Homebuilders rallied sharply following the announcement. KBHome and Ryland Group surged more than 5 percent each.

"The overall consensus was this was going to be the meeting where they started tapering—and to the extent that the Fed said they're data-dependent, I think they did the right thing," said Art Hogan, managing director at Lazard Capital Markets. "Meanwhile, the market's going to celebrate a more dovish Fed in the near term, but this may not be good news in the medium term."

The Fed also downgraded its outlook for the economy. The central bank now expects gross domestic product growth will be in the 2 percent to 2.3 percent range this year, down from 2.3 percent to 2.6 percent forecast earlier this year. It also cut the 2014 forecast to 2.9 percent to 3.1 percent from 3.0 percent to 3.5 percent.

(Read more: Taper: What Wall Street's favorite buzzword means)

Treasury yields slid, with the Benchmark 10-year yield at 2.76 percent, down from 2.86 before the Fed statement.

Homebuilders rallied sharply following the announcement. KBHome and Ryland Group surged more than 5 percent each.

Apple

climbed as first reviews of the new iPhones released overnight showed

mostly positive reactions for the 5C and 5S. In addition, the tech

giant's redesigned iOS 7 mobile-operating system will be available

Wednesday as an upgrade for older iPhones and iPads.

(Read more: Apple's silence on iPhone 5C pre-orders)

BlackBerry ticked higher after the smartphone maker unveiled its new Z30 phone, in an effort to compete with the likes of Apple's new iPhone 5S and Samsung's Galaxy S4.

Shares of online travel website Priceline.com hit $1,000 for the first time.

Among earnings, FedEx rallied after the package delivery company posted quarterly results that edged above expectations. Rival UPS also ticked higher.

General Mills posted lower quarterly earnings, but shares of the cereal maker rose after the company said sales rose thanks to the addition of new businesses.

Adobe Systems reported disappointing quarterly earnings and revenue. However, shares of the software maker jumped to lead the S&P 500 gainers following news that it is seeing strong demand for its Creative Cloud service.

Enterprise software maker Oracle is slated to post earnings after the closing bell.

Caterpillar was downgraded by Baird Equity Research to "neutral" form "outperform." The brokerage pointed out that the company's 2014 growth prospects are likely "subdued."

Meanwhile, President Barack Obama said Washington is stuck in a stalemate over budgets, debt and healthcare costs, leaving government unable to function properly, speaking at a gathering of CEOs.

(Read more: Next up for the market? Government shutdown!)

On the economic front, housing starts rose less than expected, increasing 0.9 percent to a seasonally adjusted annual rate of 891,000 units in August, according to the Commerce Department. July's starts were revised down to show a 883,000-unit pace instead of the previously reported 896,000 units. Economists polled by Reuters expected a reading of 917,000 units.

The Mortgage Bankers Association said home loan applications rose 11.2 percent, after slumping 13.5 percent last week.

(Read more: Curious to see how the 'new' Dow would be performing?)

(Read more: Apple's silence on iPhone 5C pre-orders)

BlackBerry ticked higher after the smartphone maker unveiled its new Z30 phone, in an effort to compete with the likes of Apple's new iPhone 5S and Samsung's Galaxy S4.

Shares of online travel website Priceline.com hit $1,000 for the first time.

Among earnings, FedEx rallied after the package delivery company posted quarterly results that edged above expectations. Rival UPS also ticked higher.

General Mills posted lower quarterly earnings, but shares of the cereal maker rose after the company said sales rose thanks to the addition of new businesses.

Adobe Systems reported disappointing quarterly earnings and revenue. However, shares of the software maker jumped to lead the S&P 500 gainers following news that it is seeing strong demand for its Creative Cloud service.

Enterprise software maker Oracle is slated to post earnings after the closing bell.

Caterpillar was downgraded by Baird Equity Research to "neutral" form "outperform." The brokerage pointed out that the company's 2014 growth prospects are likely "subdued."

Meanwhile, President Barack Obama said Washington is stuck in a stalemate over budgets, debt and healthcare costs, leaving government unable to function properly, speaking at a gathering of CEOs.

(Read more: Next up for the market? Government shutdown!)

On the economic front, housing starts rose less than expected, increasing 0.9 percent to a seasonally adjusted annual rate of 891,000 units in August, according to the Commerce Department. July's starts were revised down to show a 883,000-unit pace instead of the previously reported 896,000 units. Economists polled by Reuters expected a reading of 917,000 units.

The Mortgage Bankers Association said home loan applications rose 11.2 percent, after slumping 13.5 percent last week.

(Read more: Curious to see how the 'new' Dow would be performing?)

—By CNBC's JeeYeon Park (Follow JeeYeon on Twitter:

THURSDAY: Jobless claims, current account, existing home sales, Philadelphia Fed survey, leading indicators, natural gas inventories, Fed's Pianalto speaks, Fed balance sheet/money supply, Microsoft analyst mtg, Nike shareholder mtg, weekly rail numbers; Earnings from ConAgra, Rite Aid

FRIDAY: Fed's George speaks, Fed's Bullard speaks, Fed's Kocherlakota speaks, quadruple witching, new iPhones in stores

What's Trending on CNBC.com:

@JeeYeonParkCNBC) On Tap This Week:

THURSDAY: Jobless claims, current account, existing home sales, Philadelphia Fed survey, leading indicators, natural gas inventories, Fed's Pianalto speaks, Fed balance sheet/money supply, Microsoft analyst mtg, Nike shareholder mtg, weekly rail numbers; Earnings from ConAgra, Rite Aid

FRIDAY: Fed's George speaks, Fed's Bullard speaks, Fed's Kocherlakota speaks, quadruple witching, new iPhones in stores

What's Trending on CNBC.com:

0 σχόλια:

Δημοσίευση σχολίου

Ο σχολιασμός επιτρέπεται μόνο σε εγγεγραμμένους χρήστες